Smartest ways to verify the credentials of a Medicare agent

Wiki Article

Understand All the Benefits of Dealing With a Medicare Advisor for Your Plan Selection

Maneuvering through the intricacies of Medicare can be testing for lots of people. Collaborating with a Medicare advisor uses vital insights right into offered options. These professionals supply tailored suggestions based upon economic situations and unique needs. They likewise clear up crucial enrollment deadlines and prospective fines. Comprehending the nuances of Medicare insurance coverage is vital. The benefits of such support can significantly impact one's health care journey. Discovering these advantages can disclose valuable strategies for reliable plan choice.Proficiency in Medicare Options

When maneuvering through the intricacies of Medicare, people often take advantage of seeking advice from an expert that possesses a deep understanding of the various alternatives offered. These advisors are well-versed in the ins and outs of Medicare Components A, B, C, and D, permitting them to clear up the distinctions and ramifications of each - Medicare agents in. Their experience extends to comprehending qualification demands, enrollment durations, and the nuances of additional strategiesBy leveraging their knowledge, they can help people navigate prospective pitfalls, guaranteeing that beneficiaries choose one of the most appropriate coverage based on their distinct healthcare demands and financial circumstances.

Furthermore, Medicare advisors remain upgraded on the most up to date modifications in policies and regulations, supplying customers with the most present info. This support not just alleviates complication yet also equips individuals to make educated choices, eventually leading to higher complete satisfaction with their Medicare strategy options.

Customized Strategy Suggestions

Medicare advisors play a pivotal function in crafting tailored strategy suggestions tailored to each individual's unique health care demands. By thoroughly reviewing a customer's clinical background, spending plan, and choices, these advisors can determine one of the most appropriate Medicare plans offered. They evaluate various aspects, including coverage choices, costs, and service provider networks, assuring customers receive optimal worth from their selected strategies.Medicare advisors remain updated on the most recent plan changes and insurance coverage alternatives, enabling them to offer informed recommendations that align with present regulations. They additionally take into consideration way of living factors and particular health and wellness problems that may influence a client's health care decisions. This customized method not only improves the customer's understanding of their selections yet likewise constructs self-confidence in choosing a strategy that best meets their requirements. Eventually, the know-how of Medicare advisors guarantees that individuals browse the complicated landscape of Medicare with customized solutions for optimal wellness care monitoring.

Browsing Registration Target Dates

Exactly how can individuals guarantee they don't miss out on essential enrollment target dates for Medicare? One effective strategy is to collaborate with a Medicare advisor that specializes in the registration procedure. These specialists provide crucial advice on the various enrollment durations, consisting of the First Enrollment Period, General Registration Duration, and Special Registration Durations, making certain people understand when to act.In addition, advisors can help set reminders for vital dates, permitting people to preserve focus on their healthcare demands instead of solely on deadlines. They can also clarify the ramifications of missing out on these due dates, which may lead to delayed insurance coverage or greater costs. By partnering with a Medicare advisor, individuals can browse the occasionally intricate landscape of registration target dates with self-confidence, lowering the risk of expensive mistakes. Inevitably, this aggressive strategy leads to more informed decisions and better healthcare outcomes.

Comprehending Advantages and Expenses

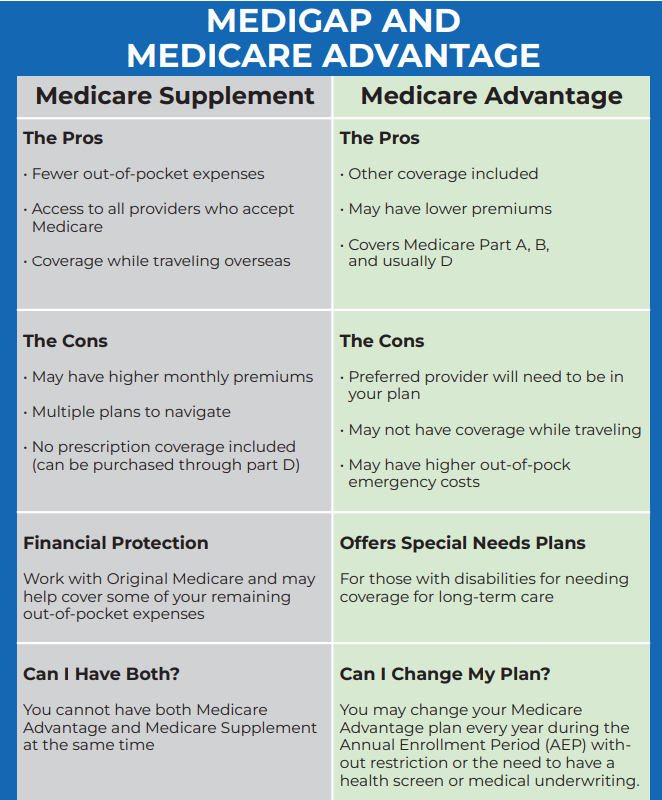

Maneuvering through Medicare's enrollment due dates is just the start of the process; understanding the costs and benefits connected with the program is similarly important. Medicare uses different plans, including Initial Medicare, Medicare Advantage, and Medicare Part D, each with unique advantages and potential out-of-pocket costs. Beneficiaries must examine insurance coverage options, such as a hospital stay, outpatient solutions, and prescription drugs, to guarantee their certain health requirements are fulfilled.Comprehending costs, deductibles, copayments, and coinsurance can greatly influence a beneficiary's financial planning. A Medicare advisor can damage down these elements, helping people make educated options that line up with their health care needs and budget plans. Medicare supplement agent near me. By making clear these facets, recipients can prevent unexpected expenditures and guarantee they receive the needed treatment. Eventually, comprehending the costs and benefits connected with Medicare is crucial for making best use of coverage and decreasing financial pressure

Continuous Support and Assistance

While maneuvering through the complexities of Medicare can be intimidating, ongoing support and guidance from a Medicare advisor can substantially reduce this problem. These specialists supply constant support, assisting individuals browse the complexities of their chosen plans. They are available to answer inquiries, make clear coverage details, and attend to any kind of worries that may develop throughout the plan year.In addition, Medicare advisors keep clients educated concerning adjustments in policies and alternatives, making sure that people are always familiar with their rights and advantages. They can help with strategy modifications throughout open enrollment periods, tailoring insurance coverage to better meet evolving medical care needs. This support promotes confidence and assurance, enabling beneficiaries to concentrate on their wellness as opposed to the intricacies of their Medicare strategies. Inevitably, ongoing support from an expert works as a valuable resource, enhancing the overall experience of handling Medicare coverage and making certain beneficiaries make informed choices.

Making The Most Of Financial Savings on Health Care Expenditures

Reliable ongoing support from a Medicare advisor can additionally lead to significant savings on health care expenses. By analyzing an individual's particular medical care needs and economic scenario, a Medicare advisor can suggest plans that offer the ideal value. Medicare agent near me. They aid clients in understanding the blog nuances of copayments, deductibles, and costs, guaranteeing that recipients select plans that minimize out-of-pocket costsFurthermore, advisors can help recognize possible gaps in protection, such as prescription drugs or specialized treatment, enabling for better monetary preparation. They remain updated on adjustments in Medicare policies, enabling clients to capitalize on new programs or benefits that could lower expenses.

Ultimately, functioning with a Medicare advisor equips people to make enlightened choices that straighten with their health care requirements and budget, making best use of savings while making sure accessibility to essential care. Medicare advisor. This calculated method can bring about considerable financial relief in a typically complex healthcare landscape

Frequently Asked Questions

How Do I Discover a Certified Medicare Advisor?

To find a certified Medicare advisor, people ought to look for referrals from relied on resources, inspect online reviews, and validate qualifications via specialist organizations, ensuring the advisor is well-informed regarding Medicare laws and plans.What Are the Prices Linked With Hiring a Medicare Advisor?

Hiring a Medicare advisor normally includes either a level charge, a percent of the costs, or commission-based compensation from insurance companies. Costs can differ considerably depending upon the advisor's experience and solutions provided.Can a Medicare Advisor Assist With Long-Term Care Preparation?

A Medicare advisor can aid with lasting treatment preparation by providing guidance on available protection alternatives, aiding customers recognize benefits, and guaranteeing they make educated choices to secure proper look after future health demands.Are Medicare Advisors Compensated by Insurance Coverage Companies?

Medicare advisors can get compensation from insurance provider with payments or fees for the policies they offer. This arrangement incentivizes advisors to supply guidance, although it may influence their suggestions concerning strategy option.Exactly how Commonly Should I Meet My Medicare Advisor?

People must preferably meet with their Medicare advisor annually, or whenever significant life adjustments happen. Normal assessments guarantee that their healthcare needs straighten with readily available plans, making the most of benefits and preventing possible gaps in insurance coverage.

Medicare advisors play an essential duty in crafting customized plan referrals tailored to each person's special medical care needs. By completely examining a customer's clinical background, budget plan, and preferences, these advisors can determine the most ideal Medicare strategies offered. Medicare supplies various strategies, consisting of Original Medicare, Medicare Advantage, and Medicare Component D, each with distinctive benefits and possible out-of-pocket prices. Medicare agent. While maneuvering with the complexities of Medicare can be daunting, continuous assistance and assistance from a Medicare advisor can considerably reduce this worry. By examining a person's particular health care requirements and financial situation, a Medicare advisor can advise strategies that supply the finest worth

Report this wiki page